-

Investment Date: Feb 2021

Sector: Financial Services,

Blockchain

Country: South Korea -

Investment Date: May 2017

Sector: Digital Media

Country: Singapore -

Investment Date: Sept 2019

Sector: Financial Services, Private Markets

Country: Singapore -

Investment Date: Feb 2020

Sector: Banking

Country: South Korea -

Investment Date: Feb 2020

Sector: Payments

Country: Singapore

-

Investment Date: Feb 2021

Sector: Transportation

Country: Singapore -

Investment Date: Feb 2021

Sector: Blockchain

Country: Singapore

Pinetree Securities’ parent, Hanwha Investment & Securities, aims to establish a multifunctional real estate & infrastructure investment

platform that goes beyond the ordinary investment banking. In their strategic and high-quality portfolio, they seek to generate superior

return by leveraging operating expertise by not just underwriting but also holding, and selling-down real estate & infrastructure securities,

debt and equity investments, direct & indirect pooled fund and development mezzanine loans with speed and certainty.

-

Underwriting Seoul Hotel Renaissance Development

Underwriting Seoul Hotel Renaissance Development$ 1.1 bn exclusive lead arranger of project

financing and $ 118 mn mezz loan invested -

Hold-to-Sell Tokyo Hitachi Solution Building B

Hold-to-Sell Tokyo Hitachi Solution Building B$ 25 mn equity held to date

-

Sales Brussels Square de Meeus 8

Sales Brussels Square de Meeus 8$ 85 mn equity sold-down

-

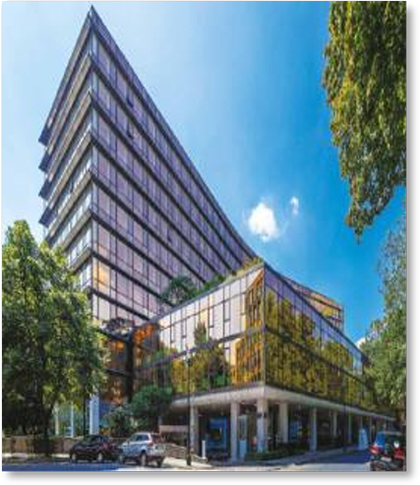

Accelerated Decision Making Prague Waltrovka Office

Accelerated Decision Making Prague Waltrovka Officefinalized $ 117 mn equity investment

in 3 weeks

The High-Quality Portfolio that includes office, retail, logistics, hospitality, infrastructure has grown

significantly since the foundation of our division in 2014, expanding rapidly across the globe.

-

2014N- Tower

DevelopmentArranged

$ 258 mn

syndicated loan Global Gateway

Global Gateway

cities OfficeInvested

$ 100 mn

equity -

2015Gate Tower Office

developementArranged

$ 292 mn

syndicated loan Hotel Renaissance

Hotel Renaissance

DevelopmentArranged

$ 1.1 bn

syndicated loan -

2016Brussel

OfficeInvested

$ 85 mn equity UK

UK

Hilton HotelInvested

$ 94 mn

mezz loan -

2017KKR Logistic

DevelopmentArranged

$ 78 mn

syndicated loan Tokyo Shinagawa

Tokyo Shinagawa

OfficeInvested

$ 120 mn

equity -

2018Japan

HotelInvested

$ 100 mn

mezz loan Czech Prague

Czech Prague

OfficeInvested

$ 117 mn

equity -

2019Spain

Solar PowerInvested

$ 169 mn

Term Loan France

France

Paris OfficeInvested

$ 200 mn

equity -

2020Silicon Valley

OfficeInvested

$ 125 mn

mezz loan Seoul

Seoul

CBD OfficeInvested

$ 42 mn

equity